In Pakistan’s fast-growing e-commerce market, with over 100 million internet users and a digital economy set to reach $6 billion by 2025, businesses need payment gateways that are secure, efficient, and built to maximize sales.

Payfast has been a go-to option for many Pakistani merchants moving away from cash-based systems. However, as businesses grow, they demand faster, more secure, and feature-packed solutions.

XPay by PostEX stands out as the top alternative, offering tools like on-site checkouts and AI-driven fraud protection that can increase transaction success rates by up to 35%.

This guide breaks down Payfast offerings, highlights XPay’s key advantages, and compares the two to show why switching to XPay can boost your business. Whether you run a Shopify store, WooCommerce, or manage a subscription service, read on to see how XPay delivers more value with fewer hassles.

What is Payfast? A Solid Option with Limits

Payfast helps businesses shift to digital payments. Designed for accessibility, it supports merchants who want quick setup and nationwide coverage, especially as mobile banking grows rapidly.

Payfast Strengths

Payfast shines in simplicity and compliance. It’s PCI-DSS certified, keeping transactions secure. As a PSO/PSP-compliant gateway, it meets State Bank of Pakistan standards. For small to medium businesses new to online payments, it’s an easy starting point.

Payfast Weaknesses

Payfast covers the basics but lacks advanced features. It doesn’t offer on-site checkouts to reduce cart abandonment, dynamic routing for better approval rates, or tokenization for recurring payments.

If Payfast is a reliable bicycle, XPay is a high-speed electric scooter, built for performance and growth.

XPay by PostEX: A Modern Payment Gateway

XPay by PostEX goes beyond a standard gateway, providing a seamless and secure payment solution tailored for Pakistan’s digital businesses. Trusted by major players like PriceOye, Domino’s Pakistan, and Deal Cart, XPay focuses on speed, security, and scalability to turn more visitors into customers. Its AI-driven tools and on-site payment options address the shortcomings of traditional gateways.

Key Features of XPay

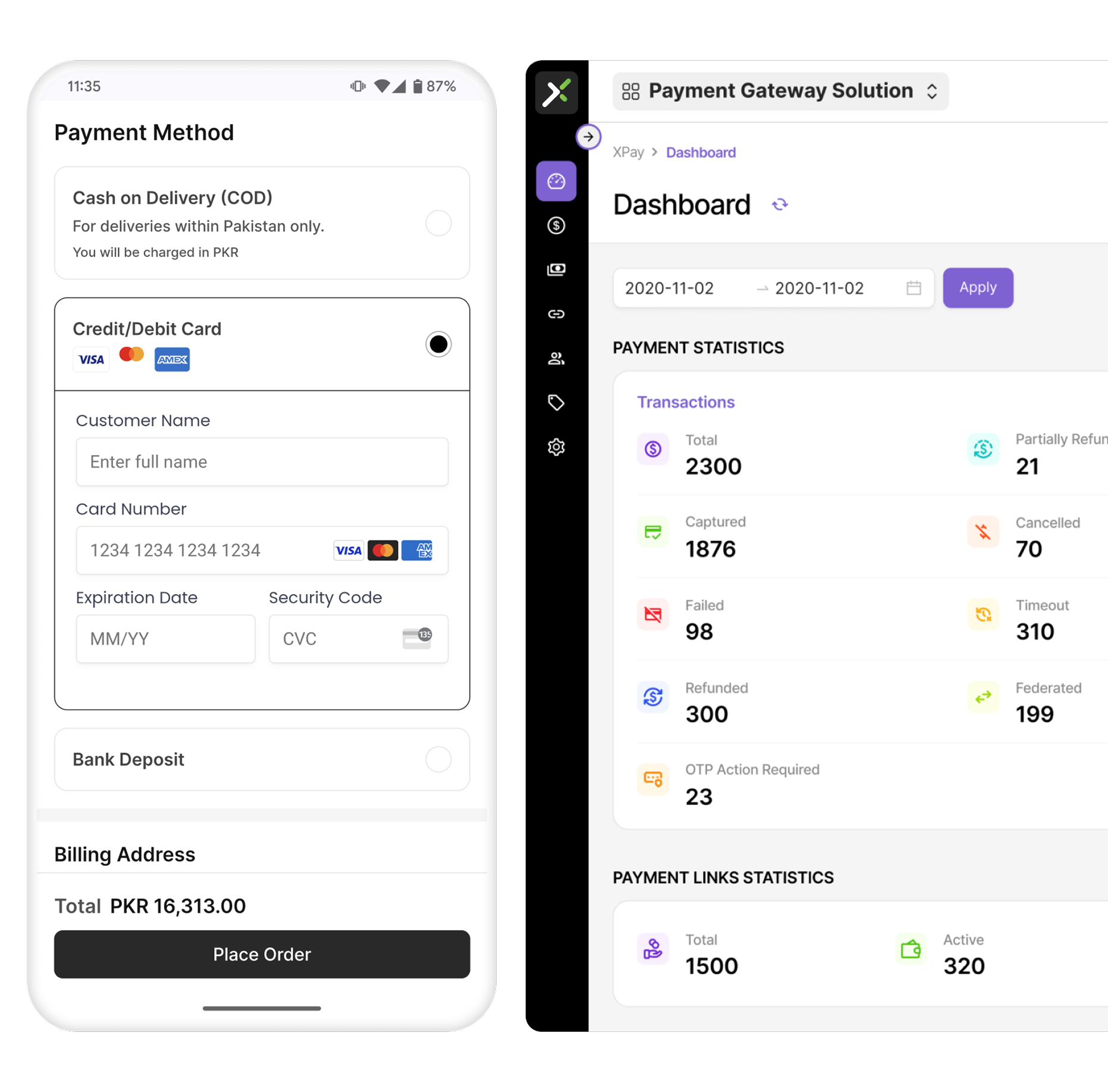

- On-Site Checkout: Customers pay directly on your website, creating a smooth, branded experience. This reduces delays, boosts completion rates by 35%, and builds trust, with no redirects to external pages.

- Wide Payment Options: Supports cards, Google Pay (with one-tap encryption), digital wallets, and tokenization for recurring payments, all through a single API.

- Subscription Tools: Manage fixed, tiered, or custom subscriptions with automated renewals and retry logic to reduce failed payments, perfect for boosting recurring revenue.

- Smart Routing & Fraud Protection: AI-driven routing optimizes transaction approvals, while XShield uses real-time data (IP, device fingerprints, BIN) to block fraud instantly, all managed via an easy admin panel.

- Quick Integrations: SDKs for React Native, Flutter, Kotlin, Swift, and more enable fast mobile app setups. Pre-built plugins for Shopify and WooCommerce mean no coding for e-commerce. Payment links allow sales via SMS or social media without tech expertise.

- Bank-Specific Offers: Provide discounts based on a customer’s bank, turning payments into marketing opportunities.

Payfast vs. XPay: A Side-by-Side Comparison

Here’s a clear comparison of the two gateways, focusing on what matters most to Pakistani merchants.

| Feature |

Payfast |

XPay by PostEX |

| Payment Methods |

Bank transfers (mobile/internet/OTC), QR/Tap & Pay via UnionPay. |

Cards, Google Pay, wallets, tokenization, all via one API. |

| Integrations |

E-commerce plugins, developer APIs. |

SDKs (React Native, Flutter, etc.), Shopify/WooCommerce plugins, payment links. |

| Checkout |

Redirect-based; no on-site option. |

On-site checkout for up to 35% higher success; branded experience. |

| Security |

PCI-DSS; “Guardian” fraud monitoring. |

PCI-DSS Level 1; XShield AI fraud detection; tokenization. |

| Subscriptions |

Basic invoicing; no advanced recurring tools. |

Full support with automated renewals and retry logic. |

| Fraud Protection |

Transaction monitoring team. |

Real-time detection (IP/BIN/email); admin panel controls; live metrics. |

| Best For |

Small businesses, billing-focused operations in Pakistan. |

E-commerce growth, subscriptions, and high-volume sales in Pakistan. |

Why Switch to XPay? The Business Benefits

Payfast works for basic needs, but XPay is built for growth. On-site checkouts can cut cart abandonment by 20-30%, a common issue with redirects. Dynamic routing boosts approval rates, especially for international cards, without extra costs. For subscriptions, tokenization and retry logic recover 15-20% of failed payments automatically, protecting revenue.

Trusted by brands like Domino’s Pakistan, XPay handles high-traffic scenarios with ease. Its no-code integrations for Shopify and WooCommerce make switching a quick task. In a market where 70% of shoppers abandon carts due to payment issues, XPay’s tools directly increase sales.

Boost Your Payments with XPay

Payfast helped pave the way for digital payments in Pakistan, but XPay by PostEX is the future, delivering seamless transactions and higher conversions. With advanced features, strong security, and a focus on sales, it’s the clear choice for merchants ready to grow.

Ready to upgrade? Book a free demo. Your next successful checkout is waiting; don’t settle for less.

.svg)